Walk into a office full of startup benefactors, and you will find someone or the other recounting their first fundraise. And why not? It’s an important milestone in any company’s jaunt, and that sigh of easing after founders get the phone call telling them they’ve got it- that’s pivotal, and very hard to forget.

Raising monies is a daunting project, especially for first-time entrepreneurs. To justify all the sweat, blood, and rips poured into a company, while someone with lifesaving stores tries to get into your ability and speak you like a book could be nerve-wracking.

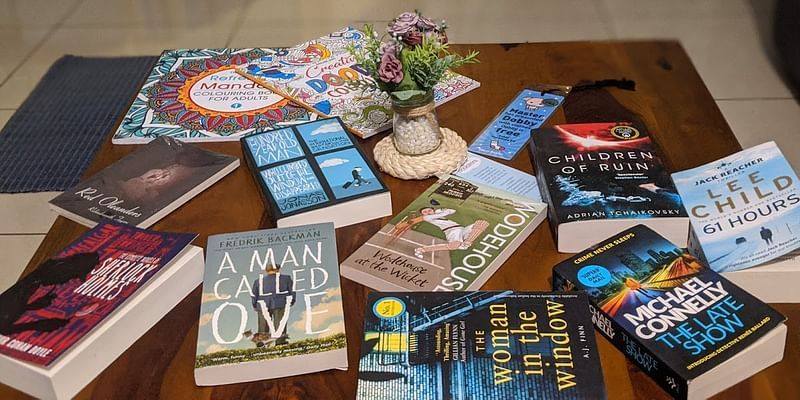

The technological processes and legalities of a fundraising use can also be quite confusing, and so being prepared departs a long way. And what better way to understand the startup and venture capital universe than between the sheets of well-written books.

Here are five records we recommend to get you started on your tour to becoming a successful entrepreneur 😛 TAGEND

Recent books

Also Read[ YS Learn] 9 things that can give your startup a billion-dollar valuationThe Art of Startup Fundraising: Pitching investors, negotiating the administer, and everything else industrialists need to know – Alejandro Cremades

Also Read[ YS Learn] 9 things that can give your startup a billion-dollar valuationThe Art of Startup Fundraising: Pitching investors, negotiating the administer, and everything else industrialists need to know – Alejandro Cremades

The book provides insight into how the landscapes around regulatory and technological changes in recent years have helped shape the startup world, and extrapolates those observations to explain what they mean for an entrepreneur looking to raise funds.

The book too preaches online funding, and how startups can source funding at different stages. It provide guidance to founders on what they need to keep in mind while pitching to investors and creating stores.

Introduction to Private Equity: Venture, Growth, LBO and Turn-Around Capital- Cyril Demaria

The book is a crash course in the various nuances of the private equity market, and how it has evolved over time. It talks about the different forms of capital available for a benefactor looking to raise monies, and how PE musicians evaluate opportunities.

Venture Capital for Dummies: Nicole Gravagna, Peter K Adams

As the epithet recommends, this book is a manual for rookies and first-time entrepreneurs. In simple, easy-to-understand terms, the book justifies the fundamentals of venture capital, and what commonly used technical terms and lingos mean. It likewise returns financiers beneficial tips-off to make their business venture-ready.

Angel Investing: The Guest Guide to Making Money and Having Fun Investing in Startups – David S Rose and Reid Hoffman( Foreword)

In the book, angel investor David Rose talks about his experience in investing in close to 90 firms, over 25 times. With the assistance of legends and lessons, the book affords readers a first-hand peek into the world of startups- what offsets them tick and what doesn’t. The book offers revelations about regulations that affect the startup world, and enrolls best traditions a flourishing company should adopt.

Also Read[ YS Learn] Leadership lessons learned from Bill Campbell – the man who mentored Larry Page, Sergey Brin, and Steve JobsWhat Every Angel Investor Wants You to Know: An Insider Reveals How to Get Smart Funding for Your Billion Dollar Idea – Brian Cohen

Also Read[ YS Learn] Leadership lessons learned from Bill Campbell – the man who mentored Larry Page, Sergey Brin, and Steve JobsWhat Every Angel Investor Wants You to Know: An Insider Reveals How to Get Smart Funding for Your Billion Dollar Idea – Brian Cohen

Brian writes from the perspective of angel investors, returning books a peek into the way people across the table, such as startup benefactors, office. The work talks about ways to find the right investor fit, the ideal way of approaching a VC, and what angel investors focus on when evaluating job opportunities.

An early investor in Pinterest, and the Chairman of the New York Angels, the author writes at length about characteristics in founders that appeal to investors, and how investors evaluate opportunities.

( Edited by Aparajita Saxena)

Want to construct your startup pilgrimage smooth? YS Education produces a exhaustive Fund and Startup Course. Learn from India& apos; s transcend investors and entrepreneurs. Click here to know more.

Read more: yourstory.com

![[YS Learn] 5 must-read books before you raise funding](https://moviesignature.co.uk/wp-content/uploads/2020/06/1591949889.jpg)

Recent Comments