The Future of Corona Virus

Corona Virus starts a disease, which is COVID-1 9. Around 50% of the people who had Corona Virus, didn’t get the Corona Virus Disease or COVID-1 9.

So as I investigate, there are mainly three possibilities of Corona Virus.

Contains and Disappear- Many viruses like SARS or Ebola were contained and ultimately disappeared. Develop a Vaccine- Pharma corporations testing and developing inoculations against the Corona Virus and ultimately become successful in developing one. The Virus Keeps Circulating- In an extreme case, the Virus hinders flowing and remains in the environment.

Depending on which one you think is more likely an outcome in the longer term, one should invest in the market.

Warren Buffett

In the current Turmoil, Warren Buffett has started investing in an Airline operators. There are news and rumors about it all over the web.

May be in India, we don’t need to be Warren Buffett and invest in an Airline company. However, this is perhaps the best time, or rather once in a lifetime opportunity to buy some of the business that can survive the Corona Virus impact.

A straightforward question that will help you to invest in the market in the title asset, and it is 😛 TAGEND

Will the company do no or very little business in 2020 and still survive?

If a company without any business can sit through the next few months and more have minimum impact when it’s back to working is the best company to invest in.

If HDFC Bank has to close all its fields now, will it be able to open up three months later and can back to business as usual?

In India, the situation is not very bad. We are only in the precautionary mode.

If your answer is YES, this is the right time to invest in these companies.

I am Buying or Rather Accumulating

I am accumulate some of the better companies in my portfolio that have rectified a lot.

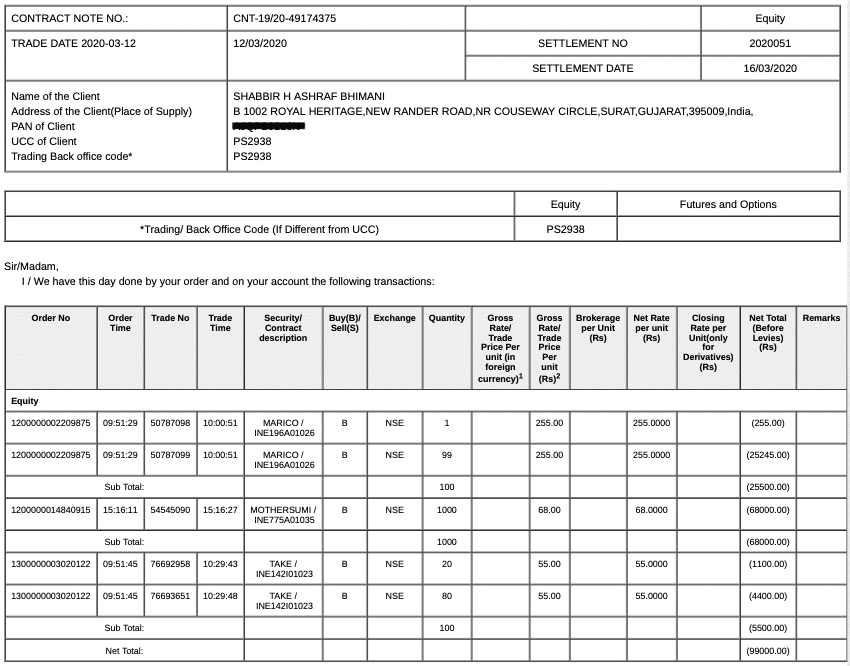

Marico and Take Solutions.

Moreover, I have one new broth in my portfolio, and it is Motherson Sumi. It is one stock that I ever wanted to have in my portfolio, but because of very high valuations, I couldn’t.

The company has a well-diversified product mix along with GEO-diversification. It overtakes the majority of members of my investment checklist but has higher than what I elevate debt to equity rate and lower than ordinary OPM.

The reason I share the contract memorandum is not to recommend the stocks that I am buying. Numerous may be saying to invest in the market, but I prefer to show that I am doing to encourage you to do as well. Grab the opportunity to invest for the coming decade- be it in stocks or mutual funds.

What if The Virus Keeps Circulating

The most pessimistic approach can be that the virus doesn’t disappear , nor is there a inoculation for it. So the Virus stops running in the environment.

My view is, the world will not end for Corona Virus. Human will develop immunity against the virus naturally.

So, I reflect the fear of the Virus will slowly reduce.

When the dread in the market recedes, the Pharma Companies can lead the mobilize or Insurance companies “il be seeing” a rush of insurers.

We will intake more prescriptions than ever before and try to get insurance for it.

So if your view is, Virus is not going anywhere, Invest in the companies that are more likely to help you crusade it.

Final Remembers

In either outcome, business like TCS, Divi’s, Asian Decorates, HUL, Nestle, Marico, Page Manufacture, Pidilite, HDFC Bank, Abbott India will continue to do the business.

Even if the environment is not contributing in order to be allowed to do the business now, the companies can be in business when things start to become ordinary. As things normalize, these companies will accelerate the growth trajectory and make the market share from companies that couldn’t survive the doom and gloom.

So last-place thing we can do is add an extra amount of SIP or some lump sum investment in mutual funds that invest heavily in these companies.

Read more: shabbir.in

Recent Comments