Are you worried about the stock market volatility and undecided how to handle it?

Let me share how a long term investor can use the current market volatility to his advantage, further, how I am dealing with this problem right now.

So without much ado, let’s begin.

Why is Stock Market So Volatile?

Do you wants to know why stock markets are so volatile?

One country decides to attack its neighbour, and the Indian stock market is down by 5 %. The next day, still the attack is on, but we are up by 3 %.

Can anyone explain what is going on?

Similarly, Corona Virus did the Indian stock market correct by 40%. Nifty from high levels of 12 k came down to 7.5 k in a matter of 4 to 5 weeks.

Nothing changed to the virus, yet the Indian stock market was back from where it started falling.

We may know the answer is liquidity, but the issues to is, why stock markets are so volatile?

The question is, WHY?

The way I see it is, stock market are future-looking. So they try to discount the future.

So anything unknown in the market clears it jittery.

What is the effect of the virus- marketplace descends How will the fighting repercussion the world- busines tumbles

How to Handle Market Volatility in 2022?

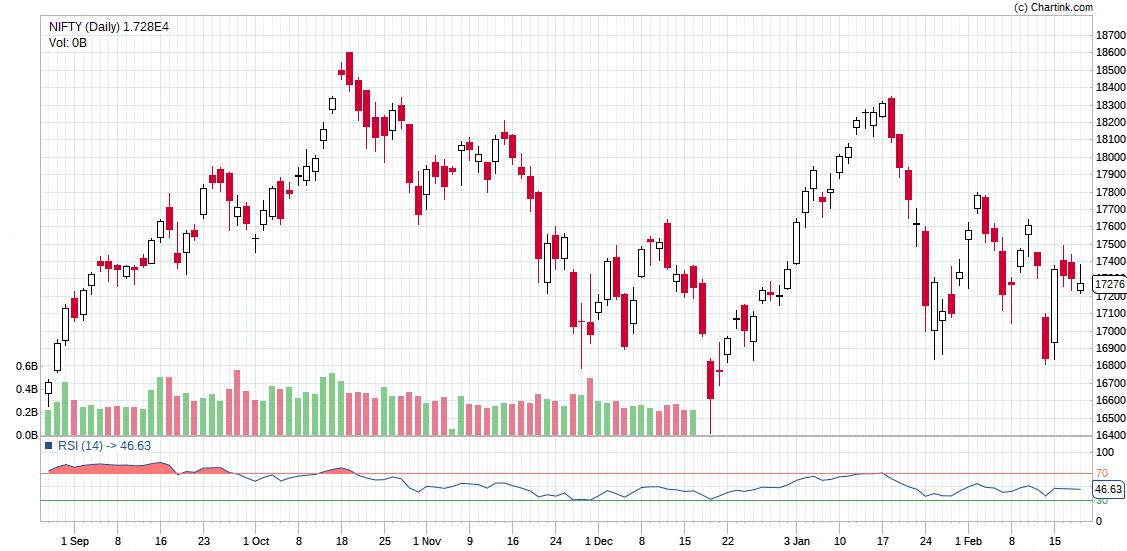

Nifty has been in a range of 2000 stations for the past seven months. Below we receive the chart of Nifty 50 for the past six months.

There is no direction.

Further, there is a gap down one day and up the other. So it is killing buyers on both sides.

The good report is investors have the upper hand. There are three ways to handle this volatility.

Do Nothing- Don’t look at your stocks. They should be of high-quality capitals for anyone to do nothing. Buy the Dips- Add more for every 5% correction in any of your stocks. Sell on rising- For dates when the market is higher, sell assets you don’t want to own for the coming decade and raise the cash positions.

I am make all three.

For assets like Divi’s Labs and Pidilite, I am doing nothing.

For capitals like Clean Science Fine Organics, I am buying the dips.

I am offloading to raise cash heights for broths like TTK Prestige that I don’t want to own for 10+ years.

Some Questions Involving Volatility of 2022?

Some blog books have asked me questions related to the volatility of 2022. So let me answer them here.

Should I Sell my Stocks When Markets Are Volatile?

It depends on your view of the market, and can you remain invested for the time frame where you think the market will remain volatile.

So if you think the market will remain volatile for the next year or so but you can’t remain invested for the next couple of years, you should book out of the positions.

However, if you can remain invested for 1+ years more than you think the market will remain choppy, you shouldn’t consider selling the stocks. So yes, you can look to book out of low-quality stock and invest in better stocks.

Should I Buy Capitals when Expenditures Fall?

Yes, if you have the money, you should consider buying either high-quality inventories or starting a SIP in some of the best mutual funds for 2022.

The volatility is not here to stay, and at some site, it has to fade away as well. So if you can ignore the volatility, you should consider buying huge corporations is accessible to a discount.

Remember, after your purchase, the stock price can precipitate. So you should be prepared for the same.

How Can I Limit Losses to my Portfolio in a Volatile Sell?

The best course to limit the losses in a portfolio is to invest exclusively in immense companionships. But, regrettably, good is insufficient to and only the great companies.

The question is how one can identify great companies.

I do it with fundamental analysis, business checklist and investment checklist. Then I use technical analysis to try to invest at a better price.

Final Thoughts

The market has always been volatile and will always remain volatile. Therefore, the investor must direct the stock market volatility and make it an advantage.

Many books and essays online say that you don’t have to pay attention to the volatility. The difficulty is when you have your hard-earned money endowed, you can’t ignore it. It’s practically not possible.

Not watching your portfolio take a 50% hit when “youve got to” too remain at home doing nothing isn’t essentially possible.

One can keep calm if one has invested in top tone business because I can say for sure that exclusively being a long-term investor is not enough.

Read more: shabbir.in

Recent Comments