I am getting the question from many of my books as well as gathering members. Why is there a strong rally in the market when the economy is in such bad chassis?

When it comes to bad news, “were having” 😛 TAGEND

Corona Virus contingencies are highest in India now. The daily number of cases is highest in the world now.( As per worldometers.info/ coronavirus) Many have forecasted Indian GDP to contract by as high as 5 %. There is so much skepticism on the second wave of the impact of the Corona Virus. There is no timeline for the Corona Virus Vaccine.

And many more.

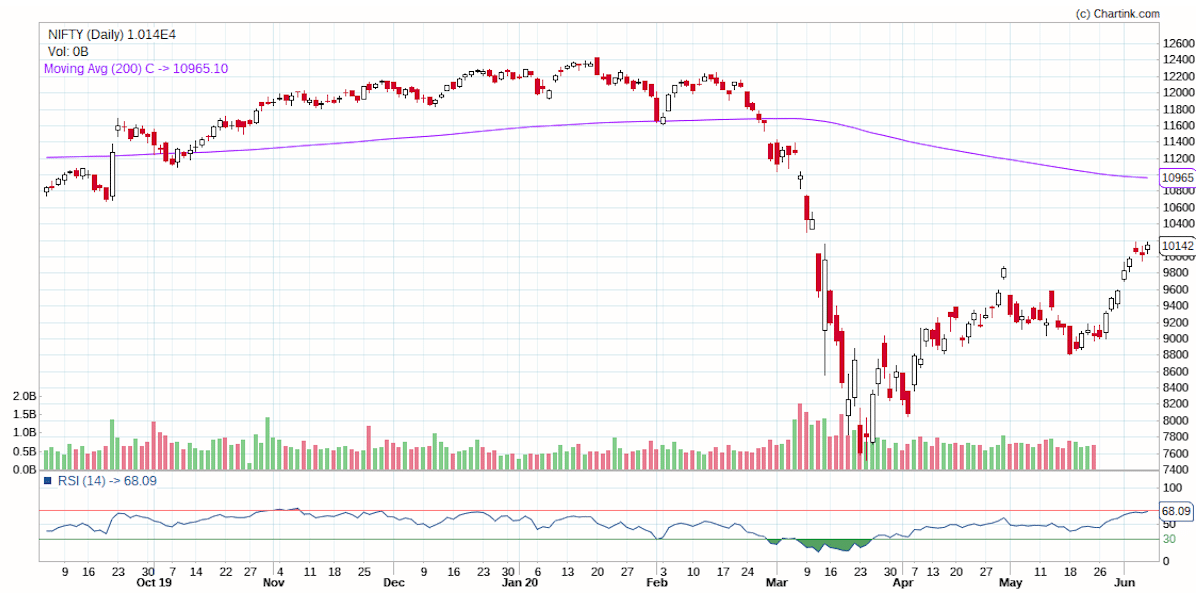

However, where reference is encounter the Nifty, it has gained 40% from the low of seven, 500 we interpreted in March 2020.

Here are the top reasonableness that I determine why the market is rallying.

1. Grocery Reverts to Mean

There are two sides to every silver, and the market is no different.

We have long and short-lived both.

In other commands, “were having” men and bears.

The market went down from 12000+ ranks to 7500 heights in a matter of days.

Even after the 40% rally from the bottom, still, the simple 200 DMA gauge in the above chart is room higher.

Maybe the current rally in the long-term context may only be a market return back to the mean.

2. Too Much Liquidity

Every country has come out with packets to help their economy.

A country like Germany has 50% of its GDP as a box to get the economy back on track.

India and the US are currently in a range of 10% of their GDP.

With so much money being printed, it is more likely that most of that money will find its path into the equity markets around the globe.

Moreover, if so much is done to save the world economies may mean the businesses that can survive knows where to find it easy to grow and thrive in the announce COVID environment.

Moreover, the economies that can control the impact of COVID can grow and thrive as well.

Each country is willing to do whatever it takes to get onto done.

3. Grocery are always Forward-Looking

The best part of the market is, they are forward-looking.

When Indian business crashed in March, the situation that was rejected was that of few months down the line.

In March the economy was not in bad shape and world markets was discounting the bad nation of the economy couple of parts down the line. Similarly, the market may be discounting some good story in the next couple of one-fourths as well.

Now with things are as they are, it may not be as bad as the market may have anticipated in March.

Remember, Mr. marketplace is channel most intelligent than every grocery participant.

Resolution

Instead of trying to find why the market went down or why the market is going higher despite the bad government of the economy, my suggestion will be to focus on how the portfolio is performing.

Why is the portfolio do inadequately? Furthermore, what you can do to make sure your portfolio doesn’t do as badly even if the market does gravely from here on.

I am investing in small-time tranches in these solid businesses and strengthening my portfolio even more.

Are you doing the same?

Read more: shabbir.in

Recent Comments