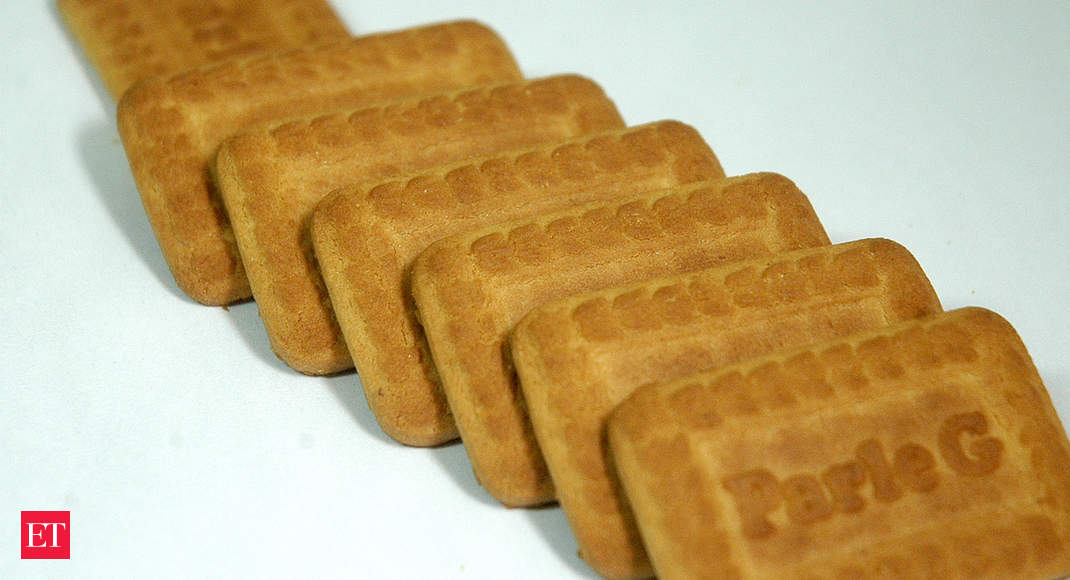

MUMBAI: An old-fashioned activity of dunking Parle-G cookies in a steam cuppa, and deftly biting off the tea-soaked half before it disintegrated over itself may have soothed the nerves of numerous suffering from lockdown off-colors. This 5-rupees-a-pack cookie came helpful for numerous immigrants who trekked hundreds of kilometers to be getting back. While numerous stocked their kitchen cabinets with Parle-Gs, the do-gooders distributed them in sacksful to the needy.Parle-G, a household brand since 1938, achieved a unique milestone of selling the maximum number of biscuits during the lockdown. Though Parle Products, the makers of Parle-G brand, refused to share specific sales numerals, they affirmed that March, April& May have been their best months in over eight decades.“We’ve arise our overall market share by practically 5 %… And 80- 90% of this growing has come from the Parle-G auctions. This is unprecedented, ” said Mayank Shah, list intelligence at Parle Products.Organised biscuit-makers such as Parle got their operations operating within a very short period after the lockdown secured on March 24. Some of these companies also formatted bring for their workers for an easier and safer commute to work. Once the factories were functional, the focus of these companies was to produce brands that drove peak sales.“Consumers were taking whatever was available – be it payment or economy priced. Some players may have focused more on payment significance SKUs as well, ” says Anuj Sethi, senior lead, Crisil Ratings, which recently carry out studies on FMCG players.“Players had been focusing on enhancing distribution reach, especially in rural areas in the past 18 -2 4 months; this worked well for them during the pandemic, ” he adds.Biscuits across premium moments have encountered a big flood in sales volumes over the past three months. Britannia’s Good Day, Tiger, Milk Bikis, Bourbon and Marie and Parle’s Krackjack, Monaco and Hide& Seek “ve sold” significant numbers during the lockdown, experts said.Parle Commodities focused on producing its best-selling-but-low-value Parle-G brand as it foresaw massive ask from all its customer segments. The company likewise reset its distribution channels within a week to ensure product availability at retail outlets.“During the lockdown, Parle-G became the solace meat for numerous; and for several others it was the only food they had on them. This is a common man’s biscuit; people who cannot afford bread- buy Parle-G, ” says Shah.“We had several state governments requisitioning us for cookies … they were in constant touch with us, requesting about our furnish prestiges. Several NGOs bought humongous quantities from us. We were lucky to have restarted production from March 25 onwards, ” contributes Shah.In normal times, Parle Produce shapes close to 400 million Parle-G biscuits every day.- and there are various recreation trivia around this mammoth count. The length between earth and the moon can be covered if a month’s production of Parle-G biscuits is stacked side by side. If you line up all the Parle-G biscuits eaten annually end-to-end, it can go around the earth 192 epoches! “In periods of value, Parle-G auctions may not be very significant … This label sells at Rs 77 per kg- which is much lower than what a kilo of rusk would expense( at about Rs 150 per kg ). But the highest ever Parle-G marketings last three months have brought us immense brand acknowledgment and following, ” says Shah.Parle Makes makes their cookies in 130 factories across the country- 120 of them are contract fabricating gangs while 10 are owned premises. Brand Parle-G descends in the’ below-Rs1 00 per kg’ cheap/ cost category- which accounts for one-third of overall industry revenues and accountings for over 50% of sales volume. The overall Indian biscuit sector is pegged at Rs 36,000 – Rs3 7,000 crore in fiscal 2020. “Premiumisation in biscuits needs to be seen in comparison with other categories within menu – such as chips, chocolates and soft drinks; most of these are more expensive than biscuits, ” illustrates Crisil’s Sethi.“So purchasers realise these trade-offs in the overall menu list – rather than within biscuits. That has led to rise in premium biscuits consumption, ” he adds.The ‘premium segment’ has been growing at a much faster rate as demand for low-priced cookies have been declining even in the rural areas of business. In expressions of value, premium cookies would have out-gunned the value segment. But in terms of numbers sold, the affordable segment led by Parle-G would have stolen a march over their pricier peers in the last three months.Tough cookies never genuinely crumble, do they?

Read more: economictimes.indiatimes.com

Recent Comments