Doji candlestick can help brokers, and even investors, to a great extent, can help identify trend reversal points on show patterns.

So let us know everything one needs to know about the Doji candlestick when selling and investing in the Market.

What is Doji Candlestick?

Doji candlestick is formed when you have open and close very close to each other, and the candlestick has a long shadow either on the upside or downside.

If you are not sure about reading candlesticks, satisfy check out my clause to understanding the candlestick now.

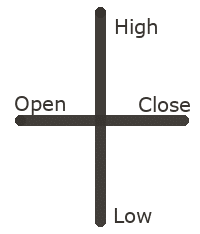

The above epitome has a Doji candlestick.

The above epitome has a Doji candlestick.

In Japanese, the “Doji” signifies a mistake. It is referring to the bursting of essential support or fight degree in the chart pattern, which can often be a mistake. When we look at the real examples, you will see how any broker can make a mistake of misreading it.

The Characters of Doji Candlesticks

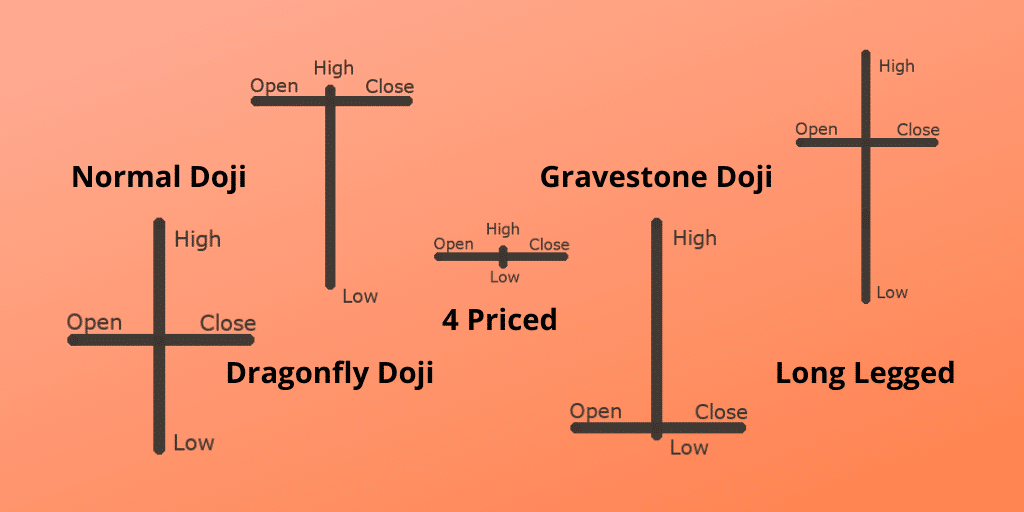

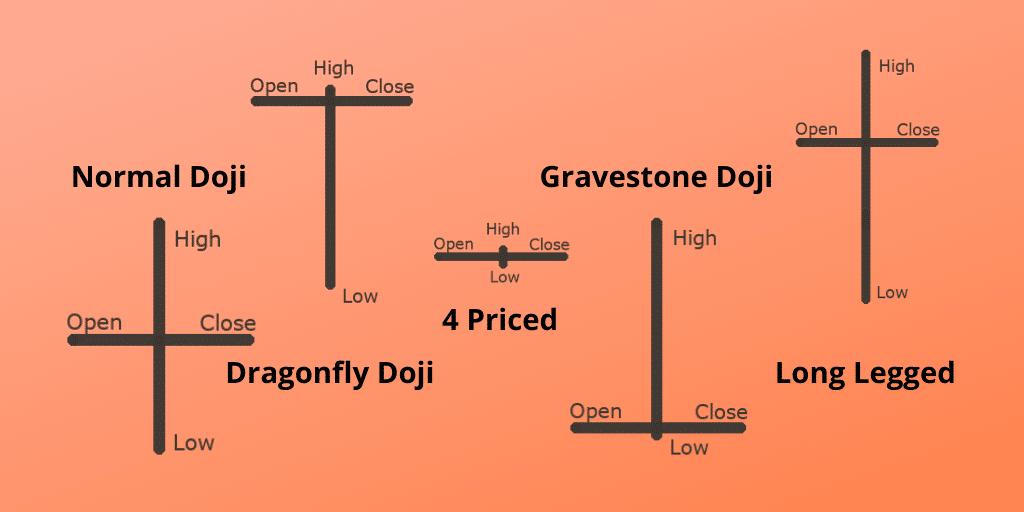

There are predominantly five types of Doji candlesticks. Depending on where is the open/ close, a Doji is described, as usual, gravestone, long-legged, dragonfly, or 4 cost Doji.

1. Normal Doji

The first and the most common form of Doji candlestick is the normal Doji.

It is very close to a plus ratify and has open and close very close to each other. Moreover, the upper form and the lower person are likewise of the same size.

Ideally, the normal Doji looks like this.

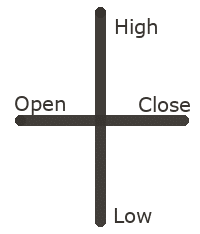

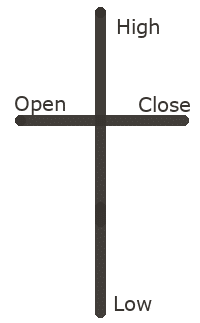

2. Long-legged Doji

When either the upper shadow or the lower darknes of the candlestick is more significant, the normal Doji becomes a long-legged Doji candle.

The Long-legged Doji looks like

In the above portrait, the pall on the lower surface has been distinguished longer, but even the upper darknes can be even longer, and it is likely to be period as long-legged Doji.

In the above portrait, the pall on the lower surface has been distinguished longer, but even the upper darknes can be even longer, and it is likely to be period as long-legged Doji.

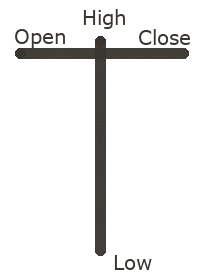

3. Gravestone Doji

When the open and close are very close to low-spirited, and there is a large shadow of the upper mas called as gravestone Doji candle.

Typically the graveyard Doji candle materializes at the top of the uptrend.

Typically the graveyard Doji candle materializes at the top of the uptrend.

After the open, the cost activity moves higher, but the upper price range is rejected, and there is a sharp-worded pres. The close is very close to the open.

Gravestone Doji is one of the few blueprints that indicate the formation of the brand-new top in the up-trending price. Moreover, it is the first signal of the bearish trend.

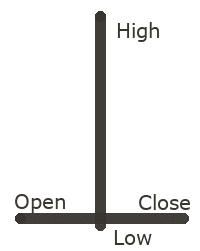

4. Dragonfly Doji

When the open and close are very close to the high-pitched, and there is a large shadow of the lower mas termed as gravestone Doji candle.

Similar to Gravestone Doji, the Dragonfly Doji also indicates the end of the bear veer and commencing from a policeman trend.

Similar to Gravestone Doji, the Dragonfly Doji also indicates the end of the bear veer and commencing from a policeman trend.

Usually, the graveyard Doji candle shows at the bottom of a downtrend.

After the open, the expenditure activity moves lower and often below significant support levels.

However, the lower rate is rebuffed, and there is a abrupt flood in rate. Often, the cost reach is very lucrative for potential investors who render the first subsistence degree, and then the short extend, as well as the formation of the bottom, makes residence, and the cost starts surging.

Moreover, it is the first signal of the uptrend.

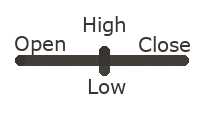

5. 4-Priced Doji

The last-place and final type of Doji is the 4-priced Doji was open, high-pitched low-spirited, and close are all very close to each other. It is a unique various kinds of blueprint that portends very low market volatility. Brokers, as well as investors, are undecided and aren’t ready to take up any arrange in the Market.

It is a unique various kinds of blueprint that portends very low market volatility. Brokers, as well as investors, are undecided and aren’t ready to take up any arrange in the Market.

The 4-priced Doji is a sign of indecision in the Market with a shallow level of grocery participation.

Awfully Life Doji Examples

Let us now understand Doji with some of the instances. I am exercising TradingView shows for all the lessons below.

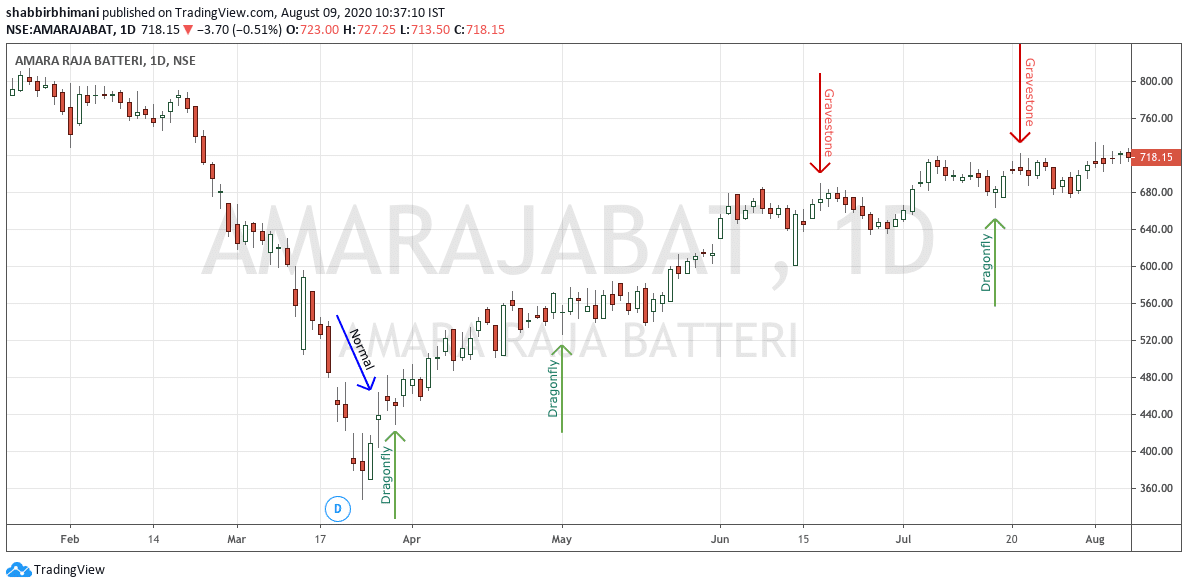

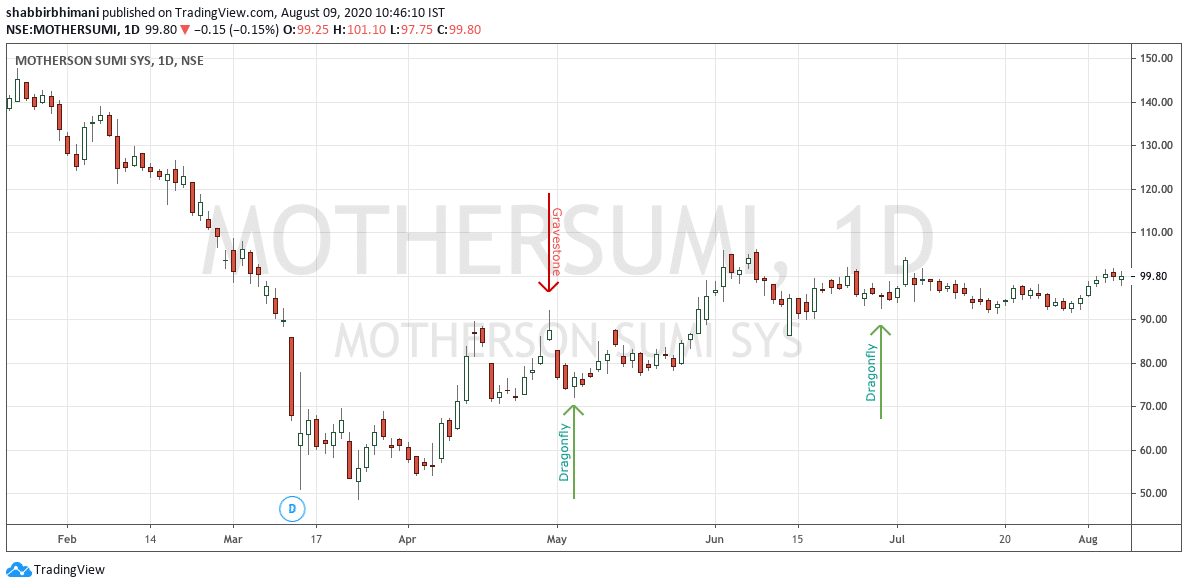

Amara Raja Batteries

The first illustration contained in the daily plans of Amara Raja Batteries.

The Normal Doji candlestick is labelled in blue.

The Normal Doji candlestick is labelled in blue.

Dragonfly Doji candlesticks are indicated in dark-green. One can see in each of the dragonfly candlesticks; there is a mini downtrend that reverses after the Doji candle for the next uptrend.

Similarly, the gravestone Doji candlesticks are indicated in red and labeled accordingly.

Did you notice that after each of the formation of gravestone Doji candlesticks, the mini uptrend in the prior candlestick switches for a mini correction in the stock price?

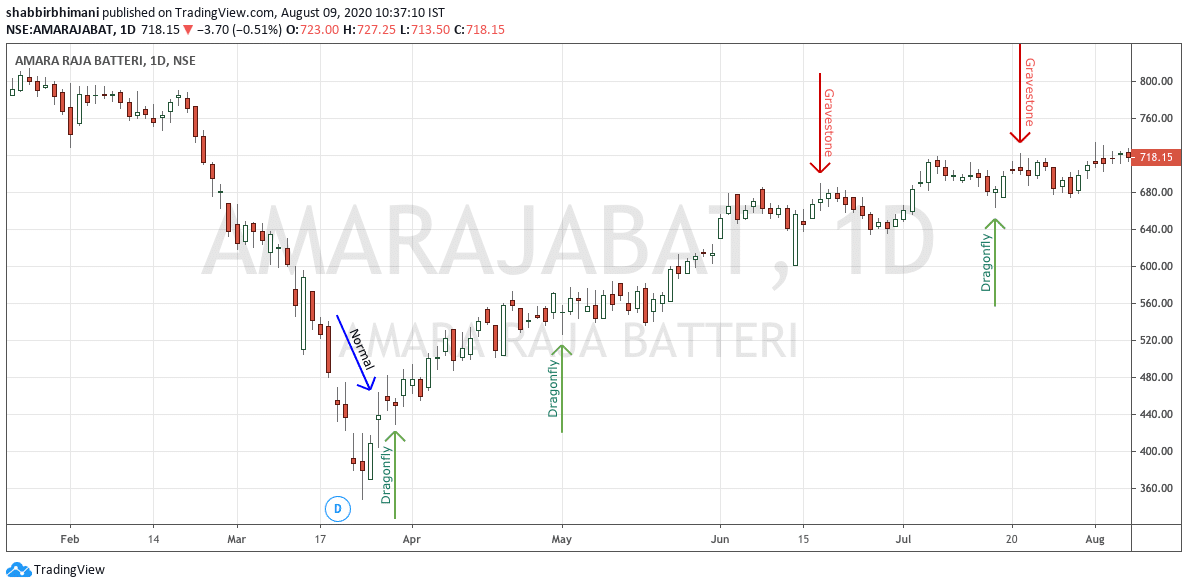

Motherson Sumi

We see similar formations of the dragonfly as well as gravestone Doji candlestick in the following chart of Motherson Sumi Systems.

The mini-trend change from each of those Doji candlesticks is visible in the daily shows of Motherson Sumi.

The mini-trend change from each of those Doji candlesticks is visible in the daily shows of Motherson Sumi.

Moreover, because Motherson Sumi is a highly transactions inventory and so the formation of any show blueprint is much better in stocks with high-pitched trading volume.

What is the relevance of Doji Candlestick?

The indispensable criteria to trade successfully in the Market is to be able to identify the minor trend within a significant trend. Moreover, one should be able to identify the trend very early to be able to give the position.

Doji candlesticks help in identifying the child vogue almost instantly and approximately on the same trading day.

Let me ask what I mean by the same trading day.

Let’s assume some stock is in a adolescent downtrend. The asset has precipitated from the levels of [?] 110 to [?] 101.

The stock opens at [?] 100 and continues the downtrend to make a low-pitched of [?] 95 intraday.

However, from the lows, the stocks starts recovering. In the closing hours, the share is very similar to [?] 100.

One can acquire the close in the stock will be around the open cost, and the pattern that formations for the daily map is gonna be a dragonfly pattern.

Opens at [?] 100, makes a high of [?] 101 and a low-toned of [?] 95 and a high probability of close again close to [?] 100.

So one can opt to trade with a bullish look on the stock on the following day.

So one can infer the daily tendency change on the same day and even before the market close.

Similarly, when the stock is in an uptrend but if the higher levels are rejected and if the stock is not able to sustain above the resistance status with a constitution of gravestone Doji candle can convey a amendment in the stock in the very near term.

Limitations of Doji

A Doji is common, and so it often isn’t very reliable to recognise a trend reversion on its own.

Moreover, there are Doji candlesticks modelled on the wrong side of things. It entails whatever it is you expect a dragonfly, but one attains a gravestone and vice versa.

The use of Doji in isolation can extrapolate very little information. One has to take into account other make indications, preferably the patronage and the resist levels.

The rejection of a critical resistance level with a constitution of Gravestone Doji candlestick is ideal.

Similarly, the breach of critical support level with a shaping of dragonfly Doji candlestick is ideal.

How to Apply Doji Candlestick motif in Market

The best application of Doji candlestick is on the daily charts.

However, in a number of cases, one can’t make a decision based on a single Doji candlestick. So then one can also find doubled Doji candlesticks one after the other.

Double Doji can give more conviction in trading with even a more reliable trend reversal move that may unfold.

In the above charts, the second gravestone commemorated Doji is a doubled Doji where you can see the candlestick before the one I have labeled is also a gravestone.

In the above charts, the second gravestone commemorated Doji is a doubled Doji where you can see the candlestick before the one I have labeled is also a gravestone.

Also read:  Best Technical Analysis Books Every Investor Should Read in 2020The best technical analysis notebooks. I have spoken some and plan to read more in 2020. Read them if you wish to be a uber-successful trader and Investor in 2020. Final Recollects

Best Technical Analysis Books Every Investor Should Read in 2020The best technical analysis notebooks. I have spoken some and plan to read more in 2020. Read them if you wish to be a uber-successful trader and Investor in 2020. Final Recollects

Doji is one of those blueprints that can help identify the trend reversion very early.

However, because it is an early show, there are chances of it flunking as well.

So buyers have to combine the buoy and fighting as well as other indicators to confirm the probability of a trend reversal indication from the formation of Doji.

Read more: shabbir.in

Recent Comments