Morgan Sindall has identified increases in advantages, turnover and net currency this year as accomplishment soared above pre-pandemic levels.

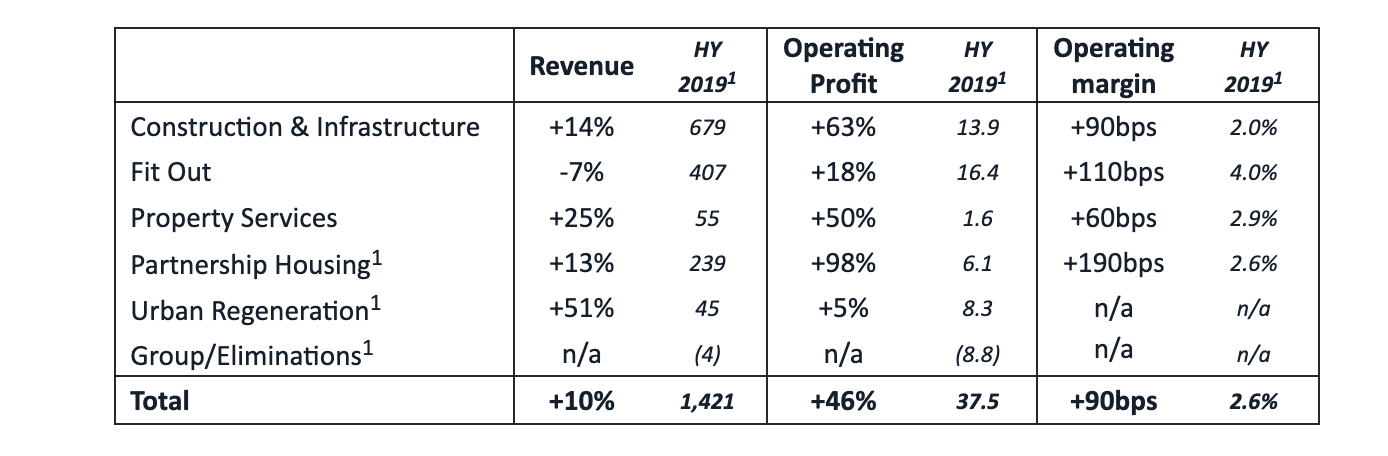

Results for the half year to June 30 2021 indicate pre tax gains of PS52. 4m- up 285% on last year and 48% on 2019 before the impact of Covid-1 9.

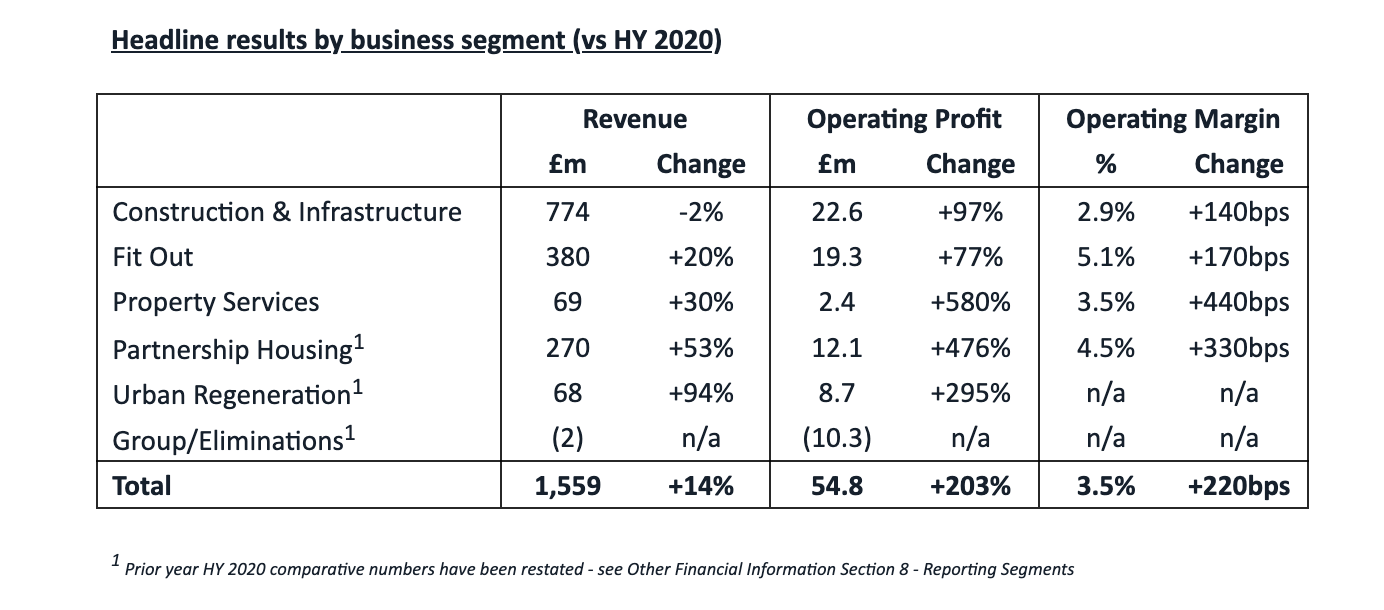

Turnover was up to PS1, 559 m from PS1, 363 m last day and PS1, 421 m in 2019 as net cash rose to PS3 37 m at the end of June from PS146m last-place occasion and PS223m in 2019.

Average daily net cash increased significantly to PS294m while perimeters nearly doubled to reached 2.9% in Construction& Infrastructure with operating earning up to PS2 2.6 m.

Chief Executive, John Morgan was delighted by the results and expects a continued strong performance for the rest of the year.

He said:” We’ve had a very strong firstly half in which we’ve refurbished our earning guidance three times. We followed up with obligate significant functional and tactical progress across the Group. With such positive impetu across all our activities, I am excited by the opportunities ahead.

” As ever, we are extremely focused on our currency generation and cash situation. Maintaining a strong balance sheet including a substantial net currency statu caters a significant competitive advantage for us. It enables us to continue shaping the right decisions for the business and to best position us in our groceries for continued sustainable long-term growth.

” Today’s decisions, combined with the current visibility for the rest of the year, hands us full confidence of another strong achievement by the working group in the second half .”

Morgan Sindall said the company was coping cloths shortages currently punching the industry.

It said:” During the first half, there have been some increases in lead times for commodity deliveries to site and a very limited number of significant price increases in certain product categories where there is greatest scarcity of supply.

” In most specimen, the impact of this has been managed at a divisional and local level without any consequent disruption to operations.

” The extra cost is connected to sourcing some information are most often been offset by a combination of contractual shield, functional its effectiveness and( in the case of Partnership Housing) by mansion sales price inflation.

” It was envisaged that these distress will normalise in the medium term and that any stoppage can be minimised through focused sourcing through the quantity order and ongoing operational effectivenes .”

The divisional outcomes compared to the previous year and 2019 were 😛 TAGEND

Read more: constructionenquirer.com

Recent Comments