Let us find the best small-cap mutual fund to invest in 2020 and evaluation the implementation of its our hand-picked of best small-cap fund of 2019.

So let’s begin.

The year 2019 was challenging for small-cap assets and predominantly small-cap funds.

The Sensex and the Nifty did well in 2019, but one can’t say the same either for the mid-cap index or for the small-cap index.

Investing in the claim furnishes and monies in 2019 obliged sure there is less red in the investor’s small-cap portfolio. Still, I belief the amount invested in 2019 in a small-cap fund, SIP or otherwise, will derive the potential benefits over day for many of the passive investors.

The Top Small-Cap Fund for 2020

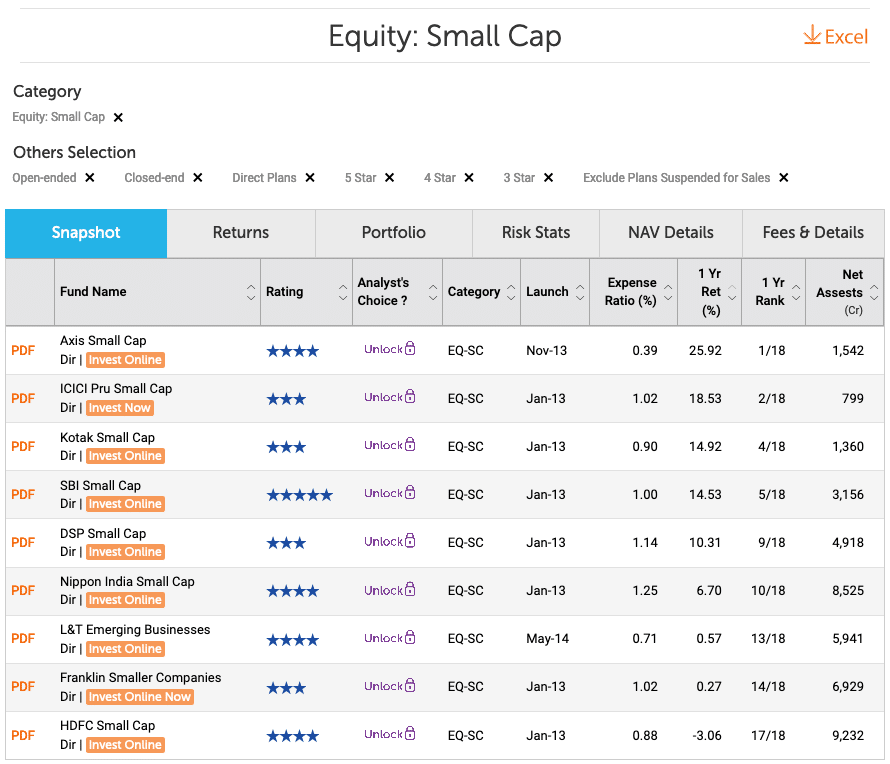

The process we will use to come to the best small-cap fund for 2020 is- from the 3, 4, and 5-star rated small-cap fund by ValueResearchOnline, we will compare the performance for the past year along with expense ratio to get the best mid-cap fund.

The reason we use 3,4 and 5 starring rated funds instead of simply 4 and 5-star rated stores is that there aren’t countless stores rated as 4 and 5 idols — exclusively 5 funds in total. The rationale is that the small-cap segment of the market has performed poorly; the funds have done inadequately as well. So there isn’t much better-rated store.

Best Small-Cap Fund To Invest in 2020

We see a diverse return from funds straying from +26% to -3 %. So a variation of nearly~ 29%.

There is a reason for such divergence as well. The funds that have done well have less revelation to small-cap furnishes as compared to those that have done poorly.

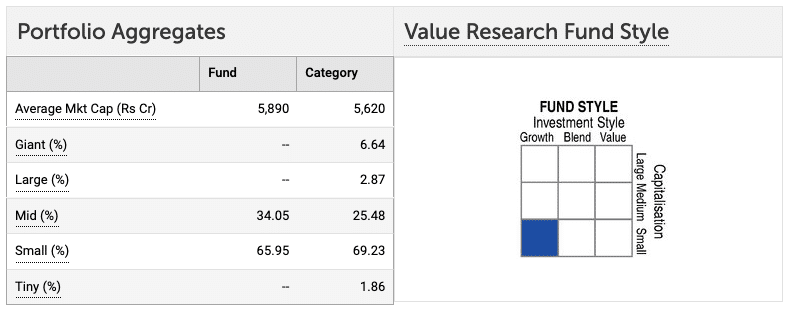

As per ValueResearchOnline, the Axis Small-Cap fund has 65% allocated to small-cap stocks.

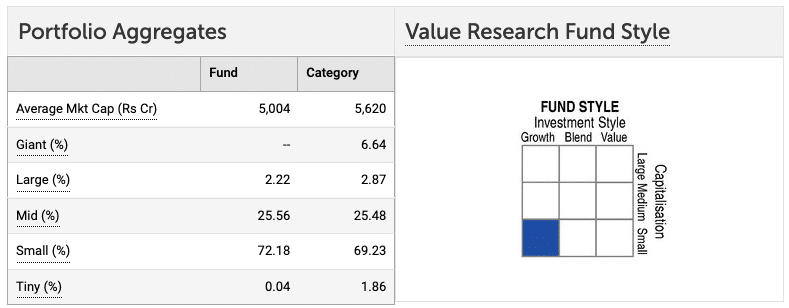

Whereas, HDFC Small-cap fund has 72%.

So if a fund remains merely 65% in small-cap stocks( as per the SEBI guidelines) to outshine can have an underperformance if the small-cap segment of world markets starts to perform well.

Axis Small Cap Fund

Going by the process of better conduct and the lower expense fraction, Axis small-cap fund has all that one are needed in order to outperform.

Moreover, as the small-cap segment of the market starts accomplishing, I am sure the fund manager will start allocating more asset towards small-cap stocks.

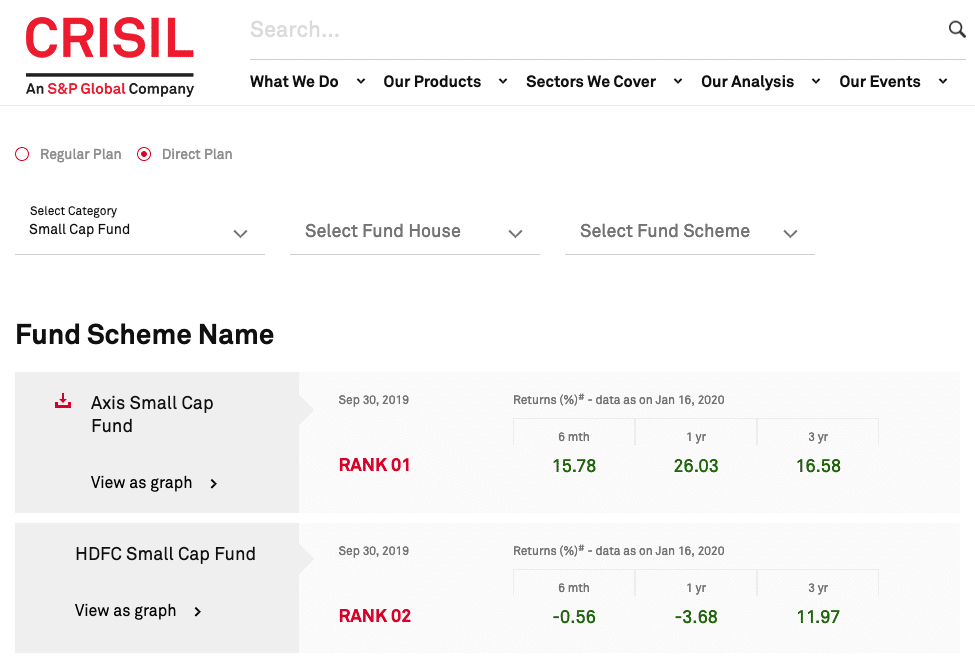

On top of that, CRISIL likewise grades Axis Small Cap Fund as the best small-cap fund for 2020.

One more site which needs a mention is the outperformance of the Axis fund house.

Axis Bluechip Fund is the best Large Cap money of 2020. Axis Midcap Fund is the best Mid-cap Fund of 2020.

HDFC Small Cap Fund

Small-cap performance depends chiefly on the choice of good and character capital that can become mid-cap and large-cap over time. So as a reverse, if I have to select another store from the small-cap segment, it will be the HDFC Small Cap fund for sure.

Averagely good expense ratio and right allocation to the small-cap segment can imply the fund can outperform for sure in the coming years.

How Well The Best Small-Cap Fund of 2019 Performed?

The most important reason I share the sequence of best monies is, we evaluate how we have done in the past. It wants either we do well investing or we learn lessons from the selection process.

The best small-cap fund of 2019 was the HDFC Small Cap fund. It has seen us learn a fundamental task, which is- small-cap investment shouldn’t be glanced on a year-on-year basis. It is all about investing in future leaders.

Moreover, market cap allocation to small-cap should be done to mitigate the risk of under-performance.

Small-Cap fund should be a small part of the portfolio unless you can handle the high volatility without being too concerned about it. Don’t always reviewed and considered the returns as the point to invest. Assess the risk accompanied when investing in the small-cap fund or stocks.

Final Anticipates

Do not switch stores every year and pay the entry and exit load or long term capital incomes tax.

In case you have not selected a better performing money earlier or want to move to a new fund for any other reason( move to regular to aim monies ). Don’t departure the investment in the old-time store. Just stop the SIP and let the expended extent remain and grow over time in the past stores. Create a new SIP in the new funds.

As ever, this isn’t an endorsement of any money. The emphasis is on the process. The stores may be doing well now, but when you want to be investing, use the same process, and find the best fund at that time to invest. Use ValueResearchOnline and CRISIL as and when you want to invest in 2020.

Read more: shabbir.in

Recent Comments