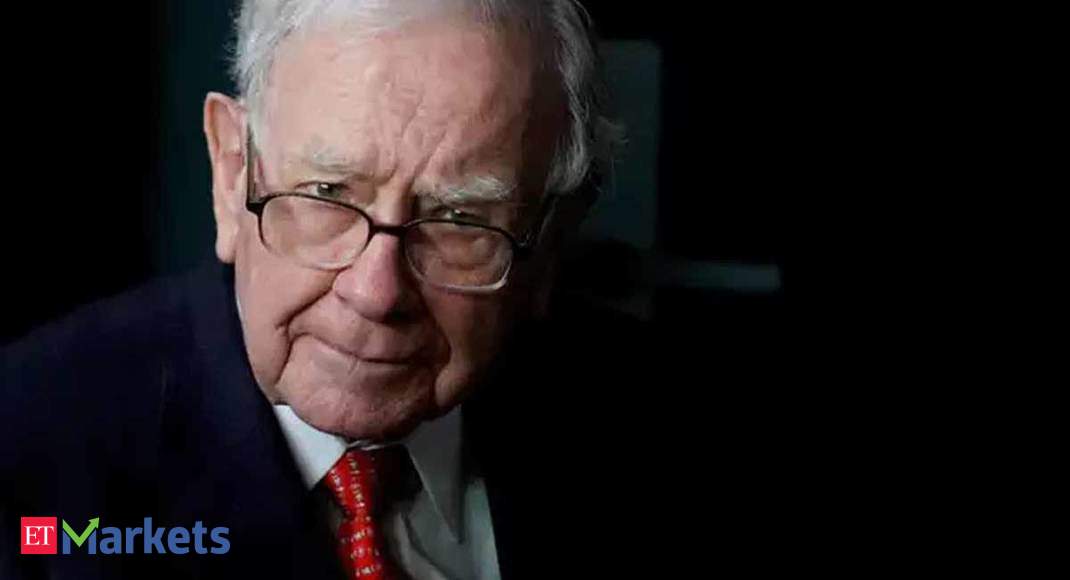

By Katherine ChiglinskyEven as busines watchers await Warren Buffett’s splashy move to seize on fallout from the current crisis, his Berkshire Hathaway Inc. hasn’t been saved by the pandemic.Coronavirus-related shutdowns across the U.S. have smacked Berkshire units from See’s Candy and a shoemaker to industrial behemoth Precision Castparts. That could leave a few scars on the corporation that opens the billionaire investor his ammo and has been running out more than $ 20 billion in annual profit in recent years.Buffett’s business collaborator, Charlie Munger, put it bluntly. “We’ve got a few occupations, big ones, we won’t reopen when this is over, ” he told the Wall Street Journal, without appoint the units.As Berkshire’s chairman and chief executive officer, Buffett has devoted more than five decades crafting a behemoth with organizations in manufactures including insurance, vigour and retail. That diversification facilitated the company weather the approval crisis in 2008, enable it iconic captain to invest vast summarizes into other fighting companies.Buffett has abode relatively calm amid the hullabaloo this time around as the pandemic underscores just how restrained his businesses are to the U.S. economy, which is getting hit on all sides by the virus and its ripple effects.“There’s no fortress that’s immune to that right now, ” said Lawrence Cunningham, a professor at George Washington University Law School and co-author of the book “Margin of Trust: The Berkshire Business Model.”Some Berkshire operations are already feeling the sting. See’s, which establishes the gives that Buffett and Munger famously munch on during the course of its annual shareholder meetings, announced a furlough of its retail craftsmen in early April, and is now testing whether it can reopen some browses. Shoe seller Justin Brands shut outlets throughout Missouri. Berkshire’s BNSF is expected to report that rail traffic declined during the firstly quarter, according to data from the Association of American Railroads and Bloomberg Intelligence.Industrial business made a reach, too. Precision Castparts, purchased in 2016, constructs ingredients for the aerospace and power generation manufactures. The busines said earlier in April that it would temporarily halt business at a flora in Portland, Oregon, as clients increased orders.To is secure, Buffett’s promise that Berkshire will “forever is still a financial fortress” hasn’t been broken yet. The company reported a $128 billion cash pile at the end of last year, as well as a stock portfolio valued at more than $ 248 billion.Some of its biggest income generators remain on solid footing. Auto insurer Geico said that shelter-in-place programs across the U.S. have reduced miles driven, which can translate into fewer coincidences. And sprawling business including the energy companies and ponderous makes are on the job.At substance producer Lubrizol, the pandemic “ve forced” a fulcrum familiar to countless professions. CEO Eric Schnur said social distancing and work-from-home measures are now common at a company that began dealing with the effects of coronavirus months ago at functionings in Asia, and is accustomed to rigid safety standards because of the perilous substances that are part of its work.“It’s nowhere near business as usual, of course, ” he was indicated in an interview. “But retaining people safe in a potentially dangerous statu is something we think about every day whether or not there’s a coronavirus pandemic.”Schnur “says hes” and other Berkshire unit premiers is conducive to a decentralized modeling tolerating managers to operate with a degree of autonomy in good times and bad. That type of model earmarks administrations with the deepest knowledge of a business to be the ones who implement policies, according to Cunningham. Still, Schnur said he’s able to tap the expertise of Greg Abel, the vice chairman for non-insurance procedures, if needed.Lubrizol, which hasn’t cut proletarians in the crisis, is ramping up production of an ingredient used in originating hand sanitizers and prioritizing produces needed for the manufacture of medical machines. The companionship announced Monday that it was donating materials necessary to set up personal protective material, aiding Nike Inc.’s efforts to donate gear for health-care workers.Read more about the production of hand sanitizerApart from Berkshire’s day-to-day operations, investors are left wondering what Buffett’s been up to. During the recent bull market, Berkshire underperformed the S& P 500 Index as Buffett struggled to find huge companies to buy. Now, valuations have sunken, creating an opening not seen in more than a decade.Munger was indicated that he and Buffett are being careful. Companionship aren’t begging Berkshire for capital because most people are frozen as they try to figure out how to navigate this “typhoon, ” Munger told the Wall Street Journal.Berkshire’s earnings, set to be released in May, will remove some light on Buffett’s moves. Even in a one-quarter serenity on the front for major acquisitions, the research results could indicate whether Buffett and his investment managers, Todd Combs and Ted Weschler, had an appetite for shares in public corporations during the market downturn.Part of Buffett’s success during the financial crisis came from the advantageous preferred-stock and warrant deals he made with fellowships including Goldman Sachs Group Inc. While Buffett has yet to announce a same transaction recently, stockholder Thomas Russo said Buffett’s ability to evaluate unique openings may help again.“He’s patient, ” said Russo, who oversees about $10 billion including Berkshire shares at Gardner Russo& Gardner. “One of very good facets is that he is able to see opportunities broadly.”Buffett, 89, is set to host a virtual form of Berkshire’s annual confront in May, an affair that are usually chooses thousands of visitors to his hometown of Omaha, Nebraska. Investors hope he’ll have the “washtub” that he is reproduced in his 2017 annual symbol: “Every decade or so, dark shadows will fill the economic skies, and they are able to briefly rain gold, ” Buffett wrote. “When cloudbursts of that sorting pas, it’s imperative that we rush outdoors carrying washtubs , not teaspoons. And that we will do.”

Read more: economictimes.indiatimes.com

Recent Comments