The birth and rise of monetary engineering developed principally over the last ten years.

So as we look forward, what does the next decade have in store? I believe we’re starting to see early indicates: in the next ten years, fintech will become portable and ubiquitous as it moves to the background and streamlines into one sit where our money is managed for us.

When I started working in fintech in 2012, I had trouble tracking competitive pursuing periods because no one knew what our sector was called. The best-known fellowships in the room were Paypal and Mint.

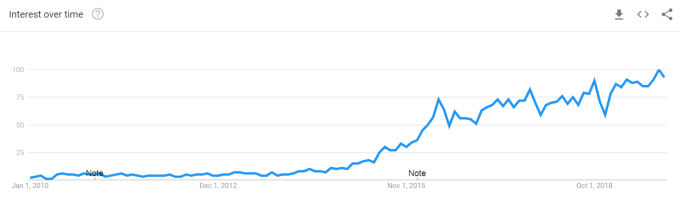

Google search volume for “fintech,” 2000- present.

Fintech has since become a household name, a shifting that came with with impressive expansion in speculation: from $ 2 billion in 2010 to over $50 billion in venture capital in 2018( and on-pace for $30 billion+ this year ).

Predictions were made along the way with mingled outcomes — banks will go out of business, banks will catch back up. Big tech will get into consumer finance. Narrow service providers will unbundle all of buyer busines. Banks and big-hearted fintechs will gobble up startups and consolidate the sector. Startups will each become their own banks. The fintech’ bubble’ will burst.

https :// techcrunch.com/ 2019/12/ 22/ who-will-the-winners-be-in-the-future-of-fintech/

Here’s what did happen: fintechs were( and continued to be) heavily verticalized, recreating the offline chapters of financial services by generating them online and inserting effectiveness. The next decade will examine very varied. Early mansions are beginning to emerge from ignored areas which suggest that financial services in the next decade will 😛 TAGEND

Be portable and interoperable: Like mobile phones, clients will be able to easily transition between’ carriers’. Become more ubiquitous and accessible: Basic business concoctions will become a commodity and introducing unbanked participants ‘online’. Move to the background: The useds of financial tools won’t have to develop 1:1 relationships with the providers of those implements. Unify into a few neighbourhoods and steer on’ autopilot’.

Prediction 1: The open data layer

Thesis: Data will be openly portable and will no longer be a competitive moat for fintechs.

Personal data has never had a moment in the spotlight relatively like 2019. The Cambridge Analytica scandal and the data breach that endangered 145 million Equifax details inspired today’s public consciousness around the importance of data security. Last month, the House of Representatives’ Fintech Task Force met to evaluate business data standards and the Senate introduced the Consumer Online Privacy Rights Act.

A tired cliche in tech today is that “data is the new oil.” Other things being equal, one would expect banks to exploit their data-rich advantage to build the best fintech. But while it’s required, data alone is not an adequate competitive moat: enormous tech companies must interpret, understand and improve customer-centric concoctions that leverage their data.

Why will this change in the next decade? Because the walls around siloed purchaser data in financial services are coming down. This is opening the playing field for upstart fintech trailblazers to compete with billion-dollar banks, and it’s happening today.

Much of this is thanks to a relatively obscure segment of legislative measures in Europe, PSD2. Think of it as GDPR for fee data. The UK became the first to implement PSD2 program under its Open Banking regime in 2018. The plan requires all vast banks to realise consumer data available to any fintech which consumer interests dispensations. So if I deter my savings with Bank A but want to leverage them to underwrite a mortgage with Fintech B, as a consumer I can now leveraging my own data to access more products.

Consortia like FDATA are radically varying attitudes towards open bank and gaining global supporting. In the U.S ., five federal monetary regulators recently came together with a rare joint testimony on the benefits of alternative data, for the most part only accessible through open banking technology.

The data seam, when it becomes open and ubiquitous, will gnaw the competitive advantage of data-rich financial institutions. This will democratize the bottom of the fintech stack and open the competition to whoever can improve the very best concoctions on top of that honestly accessible data … but construct the very best produces is still no negligible feat, which is why Prediction 2 is so important 😛 TAGEND

Prediction 2: The open protocol layer

Thesis: Basic financial services will become simple open-source etiquettes, lowering the barrier for any company to offer monetary concoctions to its customers.

Picture any asset, rich handling, trading, merchant banking, or giving arrangement. Time to get to market, these systems have to rigorously test their core functionality to avoid law and regulatory probability. Then, they have to eliminate edge clients, build a compliance infrastructure, contract with third-party vendors to provide much of the underlying functionality( study: Fintech Toolkit) and form these systems all work together.

The end result is that every financial services provider constructs similar organizations, mimicked over and over and siloed by companionship. Or really bad, they build on legacy core banking providers, with monolith methods in outdated words( hello, COBOL ). These services don’t interoperate, and each bank and fintech is forced to become its own expert at structure fiscal etiquettes ancillary to its core service.

But three trends point to how that is changing today 😛 TAGEND

First, the infrastructure and busines coating to build is being disaggregates, thanks to pulpits like Stripe, Marqeta, Apex, and Plaid. These’ investment as a service’ providers make it easy to build out basic monetary functionality. Infrastructure is currently a red-hot investment category and will be as long as more business get into financial services — and as long as infra market chairwomen can maintain price control and evaded commoditization.

Second, industry radicals like FINOS are spearheading the push for open-source financial mixtures. Consider a Github repository for all the basic functionality that underlies fintech tools. Developers could continuously improve the underlying code. Software could become standardized across the industry. Mixtures offered by different service providers could become more inter-operable if they shared their underlying infrastructure.

And third, banks and speculation administrators, realizing the cost in their own technology, are today starting to license that technology out. Examples are BlackRock’s Aladdin risk-management structure or Goldman’s Alloy data modeling planned. By giving away or selling these programs to clients, banks open up another revenue stream, make it easy for the financial services industry to work together( think of it as standardizing the language they all expend ), and open up a patron cornerstone that will provide helpful feedback, catch flaws, and petition brand-new useful concoction features.

As Andreessen Horowitz collaborator Angela Strange notes, “what that symbolizes is, there are several different infrastructure fellowships that will partner with banks and container up the licensing process and some regulatory office, and all the different payment-type systems that you need. So if you want to start a financial busines, instead of spending two years and millions of dollars in modelling tons of partnerships, you can get all of that as a service and get going.”

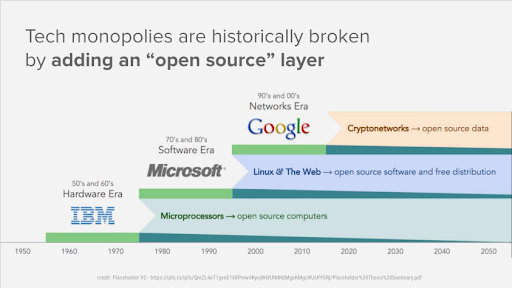

Fintech is developing in much the same way computers did: at first software and hardware came bundled, then equipment became below differentiated operating systems with ecosystem lock-in, then the internet break open software with software-as-a-service. In that path, fintech in the next ten years will resemble the internet of the last twenty.

Infographic generosity Placeholder VC

Prediction 3: Embedded fintech

Thesis: Fintech will become part of the basic functionality of non-finance products.

The concept of embedded fintech is that financial services, rather than being offered as a standalone make, will become part of the native user interface of other makes, becoming embedded.

This prediction has gained followers over the last few months, and it’s easy to see why. Bank partnerships and infrastructure software providers have inspired companionships whose core competencies are not customer investment to say “why not? ” and dip their toes in fintech’s waters.

Apple debuted the Apple Card. Amazon offers its Amazon Pay and Amazon Cash products. Facebook launched its Libra activity and, shortly afterward, launched Facebook Pay. As companionships from Shopify to Target look to own their fee and acquire investment loads, fintech will begin eating the world.

If these signals are indicative, financial services in the next decade will be a feature of the platforms with which purchasers already have a direct relation, rather than a commodity for which customers need to develop its relations with a brand-new provider to gain access.

Matt Harris of Bain Capital Ventures summarizes in a recent determine of essays( one, two) what it mean for fintech to become embedded. His argument is that financial services will be the next mantle of the’ stack’ to build on top of internet, cloud, and mobile. We now have strong tools that are constantly connected and immediately available to us through this stack, and embedded assistances like remittances, business, and credit will allow us to unlock more quality in their own homes without finagling our investments separately.

Fintech futurist Brett King puts it even more succinctly: engineering companies and massive shopper symbols will become gatekeepers for financial products, which themselves will move to the background of the user events. Many of these companies have valuable data from providing sticky, high-affinity consumer products in other disciplines. That data can give them a proprietary advantage in cost-cutting or subsidizing( eg: payment plans for brand-new iPhones ). The combination of first-order assistances( eg: procreating iPhones) with second-order embedded finance( eg: microloans) means that they can run either one as a loss-leader to subsidize the other, such as lowering the price of iPhones while increasing Apple’s take on business in the app store.

This is exciting for consumer interests of fintech, who will no longer have to search for new ways to pay, devote, save, and invest. It will be a shift for any direct-to-consumer brands, who will be forced to compete on non-brand aspects and could lose their customer affairs to aggregators.

Even so, gift fintechs stand to gain from leveraging the gathering of large-hearted tech companies to expand their reach and building off the contextual data of big-hearted tech platforms. Think of Uber journeys applauded from within Google Maps: Uber made a calculated hand-picked to directory its ply on an aggregator in order to reach more purchasers right when they’re looking for directions.

Prediction 4: Bringing it all together

Thesis: Purchasers will retrieve financial services from one central hub.

In-line with the migration from front-end consumer brand to back-end monetary plumbing, most financial services will streamline into hubs to be viewed all in one place.

For a consumer, the hub could be a smartphone. For a small business, within Quickbooks or Gmail or the cash register.

As companionships like Facebook, Apple, and Amazon split their operating system across scaffolds( ponder: Alexa+ Amazon Prime+ Amazon Credit Card ), benefits will accrue to users who are fully committed to one ecosystem so that they can manage their finances through any programme — but these providers will make their pulpits interoperable as well so that Alexa( e.g .) is nevertheless win over Android users.

As a fintech geek, I desire playing around with different monetary produces. But most people are not fintech geeks and prefer to interact with as few works as possible. Having to interface with multiple fintechs separately is ultimately cost subtractive , not additive. And good produces are designed around customer-centric intuition. In her part, Google Maps for Money, Strange calls this’ autonomous busines: ’ your financial service commodities should know your own financial position better than you do so that they are able to impel the best choices with your fund and implement them in the background so you don’t have to.

And so now we construe the rebundling of services. But are these the natural endpoints for fintech? As consumers are becoming ever more acquainted to financial services as a natural piece of other produces, they will probably interact more and more with business in the hubs from which they oversee their own lives. Tech companies have the natural advantage in make the produce UIs we enjoy — do you enjoy spending more hour on your bank’s website or your Instagram feed? Today, these centres are smartphones and laptops. In the future, could they be others, like emails, cars, phones or search engines?

As the development of fintech reflects the evolution of computers and the internet, becoming interoperable and embedded in everyday services, it will radically reshape where we manage our business and how little we “ve been thinking about” them anymore. One thing is certain: by the time I’m writing this article in 2029, fintech will search very little like it did today.

So which financial engineering firms will be the ones to watch over the next decade? Building off these trends, we’ve picked five that are able to thrive in this changing environment.

Read more: feedproxy.google.com

Recent Comments